Download Your FAFSA Checklist

Get your guide to the new 2025-2026 FAFSA process.

What Is the FAFSA?

It’s the Way to Get the Most Complete Financial Aid Package.

The Free Application for Federal Student Aid (FAFSA) determines a college student’s eligibility for financial aid. Using your financial information, including your family income, your completed FAFSA allows the government to calculate your Student Aid Index (SAI). Your SAI determines whether you qualify for federal funding (the Pell Grant). When the colleges and universities you’re accepted to receive your FAFSA information, they also use it to determine how much need-based aid the college will provide you.

No matter what your family’s income, fill out the FAFSA so you can receive a full picture of what you’ll pay for college. If you’re a New York state resident, you should also fill out your New York State Tuition Assistance Program (TAP) application, which determines whether you qualify for state aid. You’ll be prompted to go straight to the NYS TAP application when you complete your FAFSA online, so we recommend doing it all at once.

FAFSA Checklist – How to Be Ready

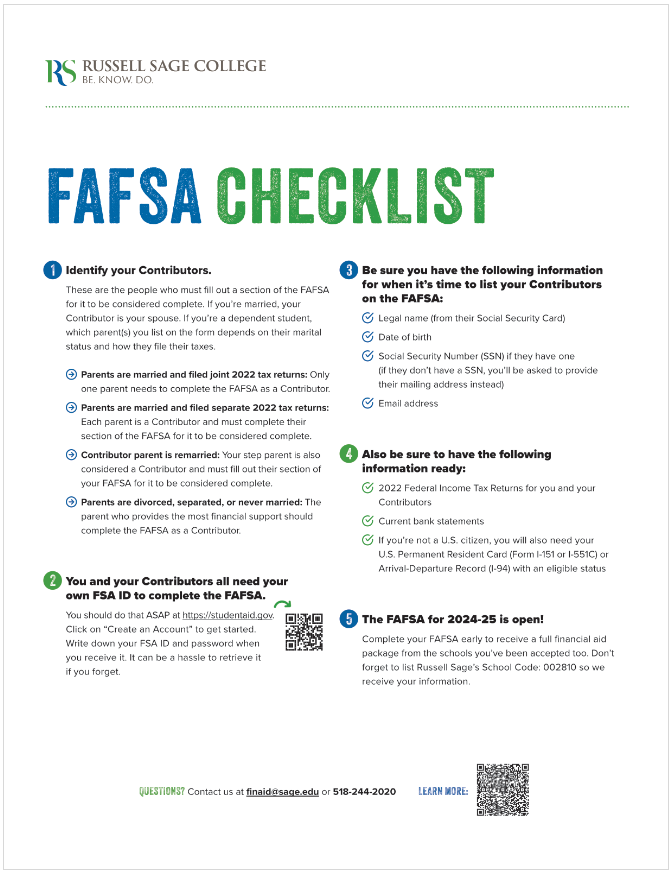

- Identify your Contributors.

These are the people who must fill out a section of the FAFSA for it to be considered complete. If you’re married, your Contributor is your spouse. If you’re a dependent student, which parent(s) you list on the form depends on their marital status and how they file their taxes.- Parents are married and filed joint 2023 tax returns: Only one parent needs to complete the FAFSA as a Contributor.

- Parents are married and filed separate 2023 tax returns: Each parent is a Contributor and must complete their section of the FAFSA for it to be considered complete.

- Contributor parent is remarried: Your step-parent is also considered a Contributor and must fill out their section of your FAFSA for it to be considered complete.

- Parents are divorced, separated, or never married: The parent who provides the most financial support should complete the FAFSA as a Contributor.

- You and your Contributors all need their own FSA ID to complete the FAFSA.

You should do that ASAP at https://studentaid.gov. Click on “Create an Account” to get started. Write down your FSA ID and password when you receive it. It can be a hassle to retrieve it if you forget. - Be sure you have the following information for when it’s time to list your Contributors on your FAFSA:

- Legal name (from their Social Security Card)

- Date of birth

- Social Security Number (SSN) if they have one (if they don’t have a SSN, you’ll be asked to provide their mailing address instead)

- Email address

- Also be sure to have the following information ready:

- 2023 Federal Income Tax Returns for you and your Contributors

- Current bank statements

- If you’re not a U.S. citizen, you will also need your U.S. Permanent Resident Card (Form I-151 or I-551C) or Arrival-Departure Record (I-94) with an eligible status

- Complete the FAFSA for 2025-2026.

Complete yours early to receive a full financial aid package from the schools you’ve been accepted to. Don’t forget to list Russell Sage’s FAFSA code: 002810 so we receive your information.

Practice for the FAFSA (And Get a Rough Idea of Aid Eligibility)

The Department of Education has created an online Student Aid Index (SAI) calculator so students and their families can get an estimate of their aid eligibility. It’s also good FAFSA practice.

In addition, you can use our Net Price Calculator to get an estimate of your cost of attendance.