- Go To Home

- A Supportive Path for The College of Saint Rose Students to Russell Sage College

- Advising FAQs

- Beacon Alert

- Conferencing & Event Services

- Download Your FAFSA Checklist

- Events

- Gator Gateway

- Graduate Programs

- Health Professions at Russell Sage College

- Introducing…The Gator Gateway

- Join Us for Sage Engage

- Pick your favorite Russell Sage College T-Shirt Design

- Russell Sage Blog

- Thank You!

- The David Pope Case: A Journey from Cold Case to Conviction

- The Russell Sage College I Can Achieve a Nursing Degree (ICAN) program

- Undergraduate Programs

- About

- Why Sage?

- Mission & History

- President’s Office

- Fast Facts

- Accolades & Accreditations

- Resources & Initiatives

- The Denise Taber Finard ’80 Women’s Institute

- Diversity, Equity & Inclusion

- Diversity, Equity & Inclusion Past Events

- Diversity, Equity & Inclusion Subcommittees

- Gender Policy & LGBTQ Resources

- Holiday, Religious, and Faith 2023 – 2024

- Priority 1: Growing Leadership

- Priority 2: Increasing Access and Success

- Priority 3: Welcoming Campus Climate

- Priority 4: Attract, recruit, support and develop a diverse community

- Priority 5: Institutional Infrastructure

- Tobacco-Free Campus

- Greener Sage

- Consumer Information

- Conferencing & Events

- Maps & Directions

- Work at Sage

- Offices & Centers

- Academics

- Flex Format School of Management Graduate Programs

- Academic Calendar

- Program Finder

- List of Academic Programs

- General Education

- Courses & Catalogs

- Print Services

- Schools

- School of Arts & Sciences

- Esteves School of Education

- School of Health Sciences

- The Albany Med Health System and Russell Sage College Healthcare Workforce Partnership

- The Speech and Language Center at Russell Sage

- Admission

- Curriculum

- Mission & Philosophy

- Partnerships

- Accelerated 3+2 M.S.

- Faculty & Staff

- Biology Program

- Health Sciences Program

- Nursing Programs

- Occupational Therapy

- Nutrition Programs

- Doctor of Occupational Therapy (OTD) Program

- Doctor of Physical Therapy Programs

- Post-Baccalaureate Pre-Medical Studies

- Psychology Programs

- Forensic Mental Health Program

- School of Management

- Evening & Weekend Programs

- Online Programs

- Academic Resources

- Advisement & Support

- Research

- Centers of Inquiry

- Council for Citizenship Education

- Dawn Lafferty Hochsprung Center for the Promotion of Mental Health & School Safety

- The Helen M. Upton Center for Women’s Studies

- The Kathleen A. Donnelly Center for Undergraduate Research

- Sage Climate Crisis Educational Center

- Sage-SIFT Alliance

- The Center for Teaching & Learning

- Institutional Review Board

- Rubin Community Fellows Program

- Broughton Graduate Fellowship

- Find Funding Sources

- Centers of Inquiry

- Special Opportunities

- Faculty

- Admission & Aid

- Undergraduate Admission

- Graduate Admission

- Apply

- Request Info

- Visit, Events & Virtual Tours

- Evening, Weekend & Online Programs

- Financial Aid & Affordability

- How to Find College Scholarships

- What to Know About the New Free Application for Federal Student Aid (FAFSA)

- Approved Certificate Programs

- First-Year Tuition, Housing and Meals, Scholarships, and Financial Aid

- Transfer Tuition, Housing and Meals, Scholarships, and Financial Aid

- Graduate Tuition and Financial Aid

- Tuition & Fees

- Financial Aid Resources

- Graduate Assistantships

- State & Federal Aid

- Institutional Aid & Scholarships

- Financial Aid FAQ

- Meet the Financial Aid Staff

- Federal Student Loan Forgiveness Programs

- Student Life

- Student Life Office

- Residence Life

- Wellness Center

- Clubs & Activities

- Spirituality Center

- Diversity, Equity, and Inclusion

- Diversity, Equity & Inclusion Coalition Members

- Diversity, Equity & Inclusion Faculty Liaisons

- Sage Allies

- Title IX

- What Is Title IX?

- Top 10 Things Students Should Know About Sage’s Title IX Process

- Top 10 Things Employees Should Know About Sage’s Title IX Process

- Students’ Bill of Rights

- Policies & Procedures

- Faculty and Staff Resources for Sexual Assault Prevention and Response

- Reporting Rights

- Reporting & Confidential Resources

- Campus Climate Executive Summary

- It’s On Us: Sexual Assault Prevention

- Career and Self-Discovery Center

- Bookstores

- The Rev

- News & Events

- Alumnae/i

- Home

- Sitemap

- New Student Welcome

Current and Transfer Students

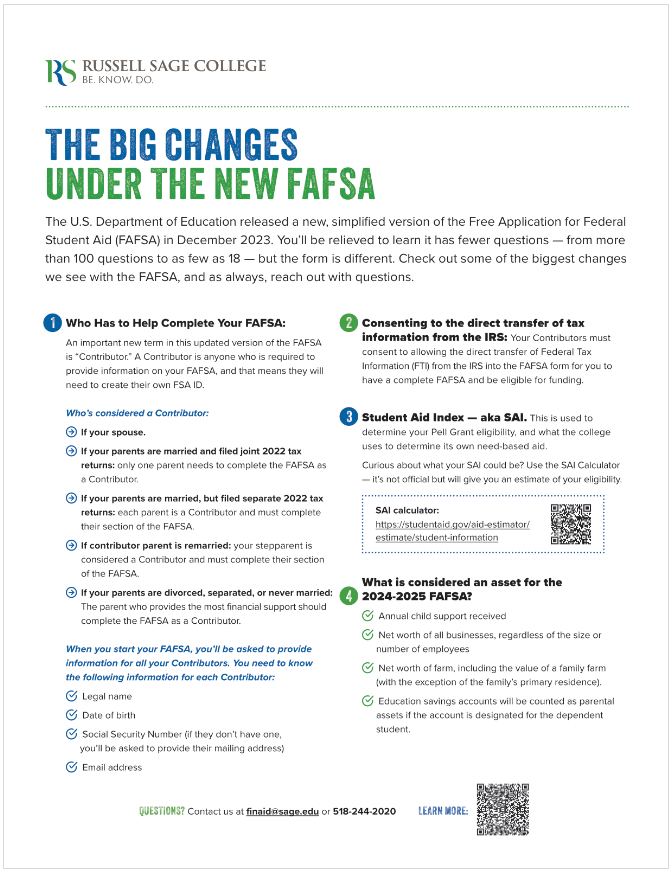

The U.S. Department of Education released a new, simplified Free Application for Federal Student Aid (FAFSA). This revised application is meant to make the process easier and is now available.

You’ll be relieved to learn it has fewer questions – from more than 100 questions to as few as 18 – but the form is different, and it’s opening later than usual. (If you’re the type of student who likes to fill out their FAFSA ASAP, 1. We appreciate you. 2. We know you’ve been waiting since October 1.)

These changes were meant to make things better: About 1.5 million more students from low-income backgrounds are expected to receive the maximum amount of Pell Grant funding, and more than 610,000 students will be eligible for Pell Grant funds when they weren’t before.

This page breaks down how things will be different with the new FAFSA.

What Are the Big Changes Under the New FAFSA?

Who Has to Help Complete Your FAFSA: A new FAFSA comes with new terms. And an important new term to know is “Contributor.” A Contributor is anyone who is required to provide info on your FAFSA, and that means they’ll also need their own FSA ID.

Anyone who is a Contributor under the new FAFSA definitions must have a FSA ID and complete their section of your FAFSA for it to be considered complete. Here’s who is considered a Contributor under the new rules:

- You’re married: Your spouse is considered a Contributor.

- Parents are married and filed joint 2022 tax returns: Only one parent needs to complete the FAFSA as a Contributor.

- Parents are married and filed separate 2022 tax returns: Each parent is a Contributor and must complete their section of the FAFSA for it to be considered complete.

- Contributor parent is remarried: Your stepparent is also considered a Contributor and must fill out their section of your FAFSA for it to be considered complete.

- Parents are divorced, separated, or never married: The parent who provides the most financial support should complete the FAFSA as a Contributor. (Before the new FAFSA, it was based on which parent you lived with for the majority of the time, so this is a change.)

Inviting Contributors: When you, as the student, start your FAFSA, you’ll be asked to provide information for all of your Contributors, and then your Contributors will be invited to complete their section of the form, using their FSA ID. You’ll need to know the following information for each Contributor:

- Legal name (from their Social Security Card)

- Date of birth

- Social Security Number (SSN) if they have one (if they don’t have a SSN, you’ll be asked to provide their mailing address instead)

- Email address

Consenting to the direct transfer of tax information from the IRS: Your contributors must consent to allowing the direct transfer of Federal Tax Information (FTI) from the IRS into the FAFSA form in order for you to have a complete FAFSA and be eligible for funding. You can still self-report income, but you must first consent to the FTI transfer.

Other New lingo: Other than being shorter and simpler, some of the terms you’ve come to know and, er … love, have changed. You won’t see an Expected Family Contribution (EFC) anymore – and it was a super-confusing term anyway. Now, when you complete the FAFSA, you will see your Student Aid Index (SAI), which is used to determine your Pell Grant eligibility, and which the college uses to determine its own need-based aid awards.

SAI Calculator: Curious about what your SAI could be? How about scratching your FAFSA itch by using the SAI Calculator? It’s not official, but it will give you an estimate of your eligibility, and it’s good FAFSA practice.

What is considered an asset has changed with the 2024-2025 FAFSA. Assets now include:

- Annual child support received

- Net worth of all businesses, regardless of the size or number of employees

- Net worth of farm, including the value of a family farm (with the exception of the family’s primary residence).

- Education savings accounts will be counted as parental assets if the account is designated for the dependent student.

Frequently Asked Questions

If you’re married, your spouse is considered a Contributor.

If you’re a dependent student, you’ll define your Contributors this way. (If you’re not sure whether you’d be considered a dependent student, go through this exercise to find out.):

- Parents are married and filed joint 2022 tax returns: Only one parent needs to complete the FAFSA as a Contributor.

- Parents are married and filed separate 2022 tax returns: Each parent is a Contributor and must complete their section of the FAFSA for it to be considered complete.

- Contributor parent is remarried: Your step-parent is also considered a Contributor and must fill out their section of your FAFSA for it to be considered complete.

- Parents are divorced, separated, or never married: The parent who provides the most financial support should complete the FAFSA as a Contributor. (Before the new FAFSA, it was based on which parent you lived with for the majority of the time, so this is a change.)

When you list your Contributors on the FAFSA, if your parent doesn’t have a social security number you will be prompted to enter their mailing address instead.

Unfortunately, you won’t be eligible for federal student aid. This can include grants, loans, and work study. Consent is required by every Contributor, regardless of their filing status.

The government expects the changes to expand the reach of Pell Grant funding. About 1.5 million more students from low-income backgrounds are expected to receive the maximum amount of Pell Grant funding, and more than 610,000 students will be eligible for Pell Grant funds when they weren’t before.

That said, changes to what assets must be reported on the FAFSA (such as businesses, regardless of the size or number of employees) might change the eligibility for a student who is currently Pell eligible. The formula to calculate Student Aid Index (SAI) is also different from the formula used under the old FAFSA to create the Expected Family Contribution (EFC) under the new funding formula. It doesn’t, for example, take into account how many children a family may have in college at the same time.

When you complete your FAFSA, if you find that your eligibility has changed, it’s a good idea to connect with the Financial Aid office and discuss your circumstances.